Exchange vs PayPal crypto: which is better for US users?

Exchange vs PayPal crypto: which is better for US users? Compare fees, supported coins, wallet transfers, limits, and trading tools to choose the best option.

If you’re in the US and want to buy crypto, you’ll usually pick one of two routes:

A mainstream payments app like PayPal (simple, familiar checkout)

A crypto exchange like Coinbase, Kraken, or Gemini (more control, more coins, often lower trading fees with “advanced” modes)

The “better” option depends on what you’re optimizing for: convenience vs control, and simplicity vs features.

What you can do with PayPal crypto (US)

PayPal’s crypto experience is designed to be easy: buy/sell inside the app, and (with extra steps) send crypto to an external wallet.

Key things that matter for US users:

Fees are shown at checkout (PayPal discloses the exchange rate and the transaction fee you’ll be charged for that buy/sell).

Coin selection is smaller (PayPal lists a mainstream set such as BTC, ETH, LTC, BCH, SOL, LINK and PYUSD).

External transfers exist, but require extra verification and you must send to the correct network/address type.

Transfer limits apply (PayPal notes a US weekly crypto transfer/send limit of $25,000; terms also mention weekly purchase limits and minimums).

When PayPal is “best”:

You’re buying a small amount occasionally (e.g., first-time BTC buy)

You want a simple UI and don’t care about advanced order types

You want to stick to major coins only

What you get with a crypto exchange (US)

Exchanges are built for trading and asset variety. The main advantages are:

More coins + more markets (spot pairs, sometimes derivatives depending on platform/eligibility)

Advanced trading tools like limit orders, stop orders, order books, and deeper pricing controls

Often lower fees for active traders when using “Advanced/Pro” trading (maker/taker fee schedules)

Examples of fee-model proof points from major exchanges:

Coinbase Advanced uses maker/taker concepts (fees vary by order type and volume tier).

Kraken uses a maker-taker fee schedule with volume incentives, and explains how fees are calculated.

Gemini ActiveTrader also uses a maker-taker model for order-book trades.

When an exchange is “best”:

You trade more than occasionally (fees add up fast)

You want limit orders and better price control

You want altcoins beyond PayPal’s supported list

You want stronger tooling for portfolio tracking/export/API use

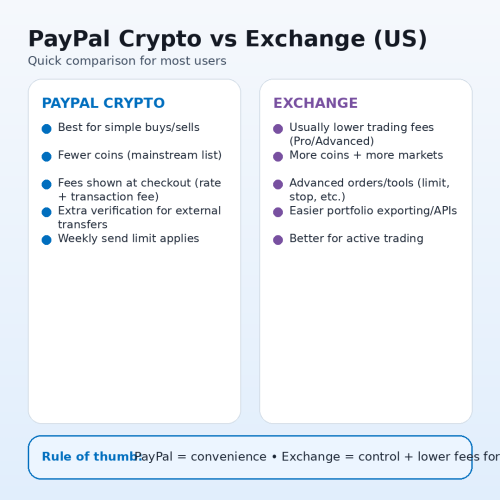

PayPal vs Exchange comparison (quick)

| Feature | PayPal Crypto | Crypto Exchange |

|---|---|---|

| Best for | Simple buying/selling of major coins | Lower-cost active trading + more control |

| Coin selection | Smaller mainstream list | Usually much larger |

| Fees transparency | Checkout shows rate + transaction fee | Maker/taker schedules in Advanced/Pro |

| Wallet transfers | Possible, with extra verification | Generally designed for deposits/withdrawals |

| Limits | Weekly send/transfer limits apply | Limits vary by exchange/account level |

| Order types | Simplified | Advanced (limit/stop/order book, etc.) |

How to decide in 30 seconds (US)

Choose PayPal crypto if:

You’re buying small amounts occasionally

You only want mainstream coins (BTC/ETH, etc.)

You prefer a simple app experience

Choose a crypto exchange if:

You want better pricing control (limit orders) and more tools

You’ll trade often and care about maker/taker fees

You want more altcoin choice than PayPal’s supported list

Practical tips (so you don’t overpay)

If you’re buying frequently, compare total cost, not just the headline fee. PayPal discloses the rate and transaction fee at checkout—check it every time.

If you’re using an exchange, learn maker vs taker (market orders often pay higher “taker” fees).

If you plan to move crypto out, understand PayPal’s transfer requirements and limits before you buy.

Conculation

For most US beginners: PayPal is a good “first step” for simple buys of major coins, because the workflow is familiar and fees are disclosed during checkout.

For anyone trading regularly or wanting more assets/tools, an exchange is usually better, since advanced platforms use maker/taker fee schedules and provide more control over execution and pricing.